Get Benefit Payments Faster

With NYSIF same-day direct deposit, your money is in your bank account the same day NYSIF issues your benefit payment. Unlike paper checks, direct deposit funds can't be lost, misplaced or stolen, which makes direct deposit a much safer and more secure alternative.

Disability Benefits/Paid Family Leave Direct Deposit FAQs

- How do I start?

Visit nysif.com and log in to your online account. If you do not have one, please create a NYSIF account by clicking Login >> Create an Account and choosing “claimant” as the account type. You will need your NYSIF claim number and a valid email address to begin. When you've completed your registration, log into your account and choose "Enroll/Manage Direct Deposit." Please note, if your disability is expected to be of short duration, you may not want to enroll in direct deposit. - What do I need to enroll?

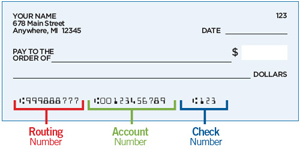

A valid checking or savings account, the name of your financial institution, your bank routing number and your bank account number.

Foreign bank accounts cannot be enrolled in NYSIF direct deposit. - When will my direct deposit begin?

Once NYSIF receives a completed direct deposit application, it will take several business days to verify your bank information. Until that time, you will receive your benefits by mail. - Will I be notified by NYSIF when payments are deposited?

Disability benefits claimants may view the status of their payments using our "Where's My Check" feature. You can also verify the direct deposit transaction via your bank account. - Will funds be available on a holiday?

If your payment date falls on a bank holiday, your payment will post on the next business day. - Can I deposit only a portion of my benefit payments to an account and the remainder into another account?

No. NYSIF direct deposit only allows for the full amount to be deposited into a single account. - Can I participate in direct deposit if I have a joint account?

Yes. You should also know that NYSIF will not provide information to joint account holders beyond what is included on your bank account statement. You should be aware that all joint account holders have the ability to access funds in a joint account, and NYSIF is not liable for any money used by your joint account holders. - Can I participate if I have more than one claim with NYSIF?

Yes. If you have more than one claim with NYSIF, you will have the option to choose which claims you would like to enroll in direct deposit. When you log into NYSIF online, your "Account Management" page will present the option of linking additional NYSIF claims to your account. Once added, you can then enroll and manage direct deposit for these claims. - What if I want to change bank accounts?

If you need to change the bank account for your direct deposit, please log in to your account and choose "Manage/Enroll Direct Deposit" to provide your new bank account information. Once NYSIF approves your new application, it will take several business days to process the change to the new account. If a payment is due in the interim, it will be sent by mail. - What if I want to cancel direct deposit?

Log in to your NYSIF online account, visit your Account Management page and click "Unsubscribe" to cancel direct deposit at any time. It may take another cycle of payments to stop this transaction, after which your next scheduled disability payment will be sent by mail. - What if I move?

Always notify your case manager if your address changes. However, moving will not affect your direct deposit unless you close or change bank accounts.

Please carefully review the Claimant's Rights and Authorizations. The authorizations apply to any NYSIF claim you enroll in NYSIF direct deposit.